When you prepare your tax return online with, we apply the correct tax rates and do all the math for you while guaranteeing 100% accuracy based on your entries.

Us federal tax brackets for 2019 plus#

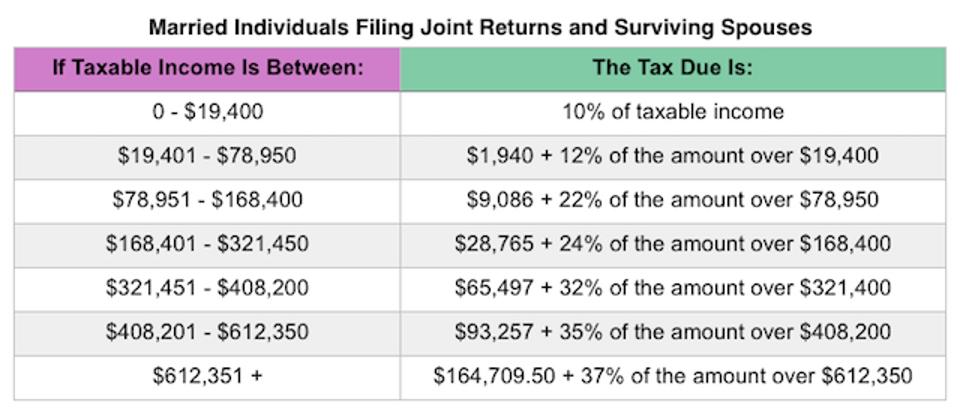

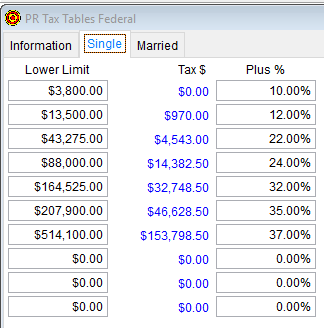

View the states with the highest and lowest tax rates plus the most tax friendly states to retire in. Our tax rate calculator does this for you.ĭid you know? The highest tax rate for United States federal taxes is 37% which applies to the top income earners while the lowest IRS tax rate is 10% - see the details below. If you added the taxes that you pay on each portion of your income, divide it by your total income, and then multiply by 100, you would get your "effective tax rate." This is the actual rate you pay on your taxes, regardless of your marginal tax rate. Keep in mind, your standard deduction will be deducted automatically from your taxable income. This pattern continues as your income grows, adding the taxable amount within each bracket to the next highest threshold. Income is actually taxed at different rates here's how it works:Īs an example, if your 2022 income is $40,000 and your filing status is single, your first $10,275 will be taxed at 10%. If your marginal tax rate is 25%, for example, that doesn't mean that ALL of your income is taxed at 25%. When someone asks what tax bracket you fall into, they generally want to know your "marginal tax rate." This is the tax bracket that your last dollar of income falls into and therefore the highest tax rate you pay. Support | 10 Tax Calculators | DEPENDucator | EICucator | Dare To Compare | Taxesfaction Marginal or Effective Income Tax Rate The following links are mentioned in this audio: Why eFile? UnMax Your Tax! Your browser does not support the audio element.

Us federal tax brackets for 2019 free#

Know what your state taxes may look like before you eFileIT! Did you know that only on can you prepare multiple state returns for one low price, not per price? Start free and pay only when you are satisfied with your return IT's that simple.Ĭalculate your IRS tax rate | Calculate your state tax rateĭon't feel like reading? Just click the audio below and listen to Tess. Select your state from the table and enter your filing status, number of dependents, and annual taxable income you can also enter federal and state deductions for more accurate results. We at have been hard at work developing a tax calculator for all states with income taxes. Before you e-file your taxes, use these simple and free tax calculators that help you optimize your personal taxes.Ĭalculate ALL state income taxes by tax rate, income, filing status, and more.Estimate your taxes now by tax year, tax rate and brackets with the RATEucator tax calculator.Most of us pay income taxes across several tax brackets which is what makes our tax system "progressive." Each filing status has its own tax bracket, but the rates are the same for all filing statuses.

0 kommentar(er)

0 kommentar(er)